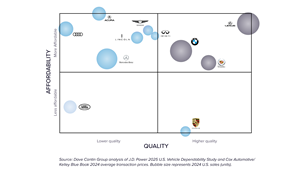

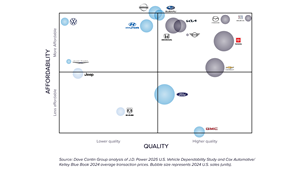

Buick, Mazda and Toyota Lead Dave Cantin Group’s New Quality & Pricing Index; Lexus Tops Luxury

Index underscores affordability as the defining force in today’s auto market, blending J.D. Power Dependability data with real-world pricing to rank 27 brands

NEW YORK, Sept. 05, 2025 (GLOBE NEWSWIRE) -- Affordability is the defining factor in today’s auto market, and the Dave Cantin Group’s (DCG) new Vehicle Quality & Pricing Index (QPI) shows which brands are best positioned to deliver it. The first-of-its-kind ranking combines J.D. Power Dependability Study data with Cox Automotive/Kelley Blue Book’s average retail transaction prices, revealing that Buick, Mazda and Toyota are setting the standard for value among mainstream brands, while Lexus leads the luxury segment. The goal of Dave Cantin Group’s new Quality and Pricing Index is to compile available industry data, analyze it, and provide a glimpse into which automotive manufacturers are best positioned in today’s challenging macroeconomic environment.

Key Findings from the 2025 QPI

- Buick, Mazda and Toyota top the mainstream rankings for overall value.

- Lexus leads luxury brands, followed closely by Cadillac.

- Brands heavily reliant on full-size trucks, including Ford, Chevrolet and GMC, scored lower due to high transaction prices.

- Chrysler, Jeep and Ram landed in the bottom tier of the index.

The findings underscore how tighter household budgets are reshaping consumer demand, with midsize and compact SUVs gaining traction over higher-priced trucks and premium vehicles.

Dave Cantin Group, a leading advisor to retail automotive groups and their owners, is dedicated to delivering exclusive data and insights to help auto dealers stay ahead of trends and plan and act strategically. The inaugural Vehicle Quality & Pricing Index is one of the latest market intelligence offerings from DCG, building on the key trends and insights highlighted biannually in the Market Outlook Report and the deep financial and operational data available on all 18,000+ U.S. new-vehicle dealerships through DCG's proprietary AI platform, Jump IQ.

“At DCG, we are constantly looking for ways to analyze data and deliver insights that help our clients – dealership principals, executives and investors – make better business decisions about where and when to invest,” DCG President Brian Gordon said. “Reliability and affordability have long been two of the most critical factors in consumer purchase decisions. The QPI shows that manufacturers delivering both are better positioned to gain market share, particularly in today’s environment.”

Building on the Midyear Market Outlook Report

The launch of the QPI reinforces findings from DCG’s 2025 Midyear Market Outlook Report (MOR), released on August 20, which identified affordability as the defining force driving every major trend in the U.S. auto industry this year. MOR highlighted how price pressure is shaping consumer openness to Chinese automakers, fueling growth in affordable EV models and forcing automakers to absorb tariffs rather than risk losing share.

The QPI adds a brand-level dimension to these insights, showing that value-focused nameplates such as Buick, Mazda, Toyota and Lexus are best aligned with shifting consumer priorities, while higher-priced, less reliable brands risk falling behind. Together, DCG’s MOR and QPI offer a comprehensive picture: affordability is not just a market challenge, but the central driver of consumer behavior, dealer strategy and competitive positioning in 2025.

Standout Brand Stories from the QPI

- Buick distinguished itself with a 7% drop in average transaction price, the lowest reported problems per 100 vehicles, and one of the industry’s strongest market-share gains in the first half of 2025.

- Toyota’s consistent reputation for value continues to fuel strong demand.

- Lexus proves that long-term dependability and premium positioning can coexist.

- Cadillac’s EV-led, more affordable move into luxury boosts its ranking.

Dealers are already experiencing these trends in real time.

“We can never get enough Toyotas. If you sent me 100 more, I’d sell them all. The demand is always there,” said Randy Hoffman, Chief Operating Officer, Ed Morse Automotive Group.

By marrying dependability metrics with transaction price realities, the DCG QPI provides dealers, automakers and investors with a powerful tool to identify which brands are best positioned for growth, and which may face headwinds as affordability pressures intensify.

The full report, including complete brand rankings and analysis, is now available through the DCG Insights Hub and featured on the Automotive News Market Insights page, editorial newsletters and social channels.

Explore the full QPI rankings and a link to download the report here.

About Dave Cantin Group

The Dave Cantin Group is a leading automotive M&A advisory company specializing in acquisitions, divestitures, intelligence, and other advisory services. The company is the M&A services provider of choice for North America’s top automotive dealership groups, advising on approximately 40 transactions annually. DCG is differentiated by its advisory approach, long-term lens on client relationships, and commitment to market intelligence tools that inform DCG and client strategies. In 2023, DCG became the only retail automotive M&A company with a significant strategic investor, welcoming Kaltroco to the DCG family.

Through its M&A intelligence division, DCG produces automotive content and delivers relevant, timely market intelligence, including the automotive industry Market Outlook Report (MOR). Together with CBT News, DCG produces the Inside M&A studio show and podcast to share stories, news, and trends impacting the retail automotive industry. DCG’s proprietary AI-enabled software, Jump IQ, anchors its advisory services that support retail automotive dealers in developing informed M&A strategies and making smarter M&A decisions.

The company’s nonprofit initiative, DCG Giving, funds child and adolescent cancer research and treatment in communities nationwide and other worthy charitable initiatives. DCG team members regularly feature on the industry speaking circuit and are often cited by top national and global news outlets. For more information, please visit davecantingroup.com.

Media Contact:

Katie Merx

katiemerx@gmail.com

313.510.5090

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/894385ba-2f38-484e-aa3f-03b7950a77ee

https://www.globenewswire.com/NewsRoom/AttachmentNg/5cc12017-e774-4af3-b881-5f69278411b5

https://www.globenewswire.com/NewsRoom/AttachmentNg/c3ae9e57-b598-4b96-a9bf-e4139a1313e0

DCG_QPI 2025

Affordability is the defining factor in today’s auto market, and the Dave Cantin Group’s new Vehicle Quality & Pricing Index shows which brands are best positioned to deliver it. The first-of-its-kind ranking combines J.D. Power Dependability Study data with Cox Automotive/Kelley Blue Book’s average retail transaction prices, revealing that Buick, Mazda and Toyota are setting the standard for value among mainstream brands, while Lexus leads the luxury segment.

DCG_QPI_Luxury_2025

Affordability is the defining factor in today’s auto market, and the Dave Cantin Group’s new Vehicle Quality & Pricing Index shows which brands are best positioned to deliver it. The first-of-its-kind ranking combines J.D. Power Dependability Study data with Cox Automotive/Kelley Blue Book’s average retail transaction prices, revealing that Buick, Mazda and Toyota are setting the standard for value among mainstream brands, while Lexus leads the luxury segment.

DCG_QPI_Mainstream_2025

Affordability is the defining factor in today’s auto market, and the Dave Cantin Group’s new Vehicle Quality & Pricing Index shows which brands are best positioned to deliver it. The first-of-its-kind ranking combines J.D. Power Dependability Study data with Cox Automotive/Kelley Blue Book’s average retail transaction prices, revealing that Buick, Mazda and Toyota are setting the standard for value among mainstream brands, while Lexus leads the luxury segment.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.